library(tidyverse)

library(DBI)

library(scales)

library(lmtest)

library(sandwich)6 Univariate Portfolio Sorts

6.1 Data Preparation

tidy_finance <- dbConnect(

duckdb::duckdb(),

"data/tidy_finance.duckdb",

read_only = TRUE)There are three tables used for this chapter. I defer the select() used with crsp_monthly in the book, as I find it more elegant to have a code chunk that just links to the database tables.

crsp_monthly <- tbl(tidy_finance, "crsp_monthly")

factors_ff_monthly <- tbl(tidy_finance, "factors_ff_monthly")

beta <- tbl(tidy_finance, "beta_alt")6.2 Sorting by Market Beta

beta_lag <-

beta |>

mutate(month = month + months(1)) |>

select(permno, month, beta_lag = beta_monthly) |>

filter(!is.na(beta_lag))

data_for_sorts <-

crsp_monthly |>

select(permno, month, ret_excess, mktcap_lag) |>

inner_join(beta_lag, by = c("permno", "month"))breakpoints <-

data_for_sorts |>

group_by(month) |>

summarize(breakpoint = median(beta_lag, na.rm = TRUE),

.groups = "drop")

beta_portfolios <-

data_for_sorts |>

inner_join(breakpoints, by = "month") |>

mutate(

portfolio = case_when(

beta_lag <= breakpoint ~ "low",

beta_lag > breakpoint ~ "high")) |>

filter(!is.na(ret_excess)) |>

group_by(month, portfolio) |>

summarize(ret = sum(ret_excess * mktcap_lag, na.rm = TRUE)/

sum(mktcap_lag, na.rm = TRUE),

.groups = "drop")6.3 Performance Evaluation

beta_longshort <-

beta_portfolios |>

pivot_wider(id_cols = month, names_from = portfolio, values_from = ret) |>

mutate(long_short = high - low) |>

collect()model_fit <- lm(long_short ~ 1, data = beta_longshort)

coeftest(model_fit, vcov = NeweyWest)

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.00013932 0.00107096 0.1301 0.89656.4 Functional Programming for Portfolio Sorts

Using the ntile() function, the assign_portfolio() function can be reduced to a one-liner. As such there is no reason to have a function, but I have retained this to illustrate the use of the curly-curly operator as shown in the book.

assign_portfolio <- function(data, var, n_portfolios) {

mutate(data, portfolio = ntile({{ var }}, n_portfolios))

}Using a “data-frame-in-data-frame-out” function results in tidier code. Because the data are still in the database, we use our home-brewed alternative to weighted.mean() and defer the conversion of portfolio to a factor until we collect() the data below.

beta_portfolios <-

data_for_sorts |>

group_by(month) |>

assign_portfolio(var = beta_lag, 10) |>

group_by(portfolio, month) |>

summarize(ret = sum(ret_excess * mktcap_lag, na.rm = TRUE)/

sum(mktcap_lag, na.rm = TRUE),

.groups = "drop")6.5 More Performance Evaluation

Unlike the book, I use the coef() function here for a small amount of convenience.

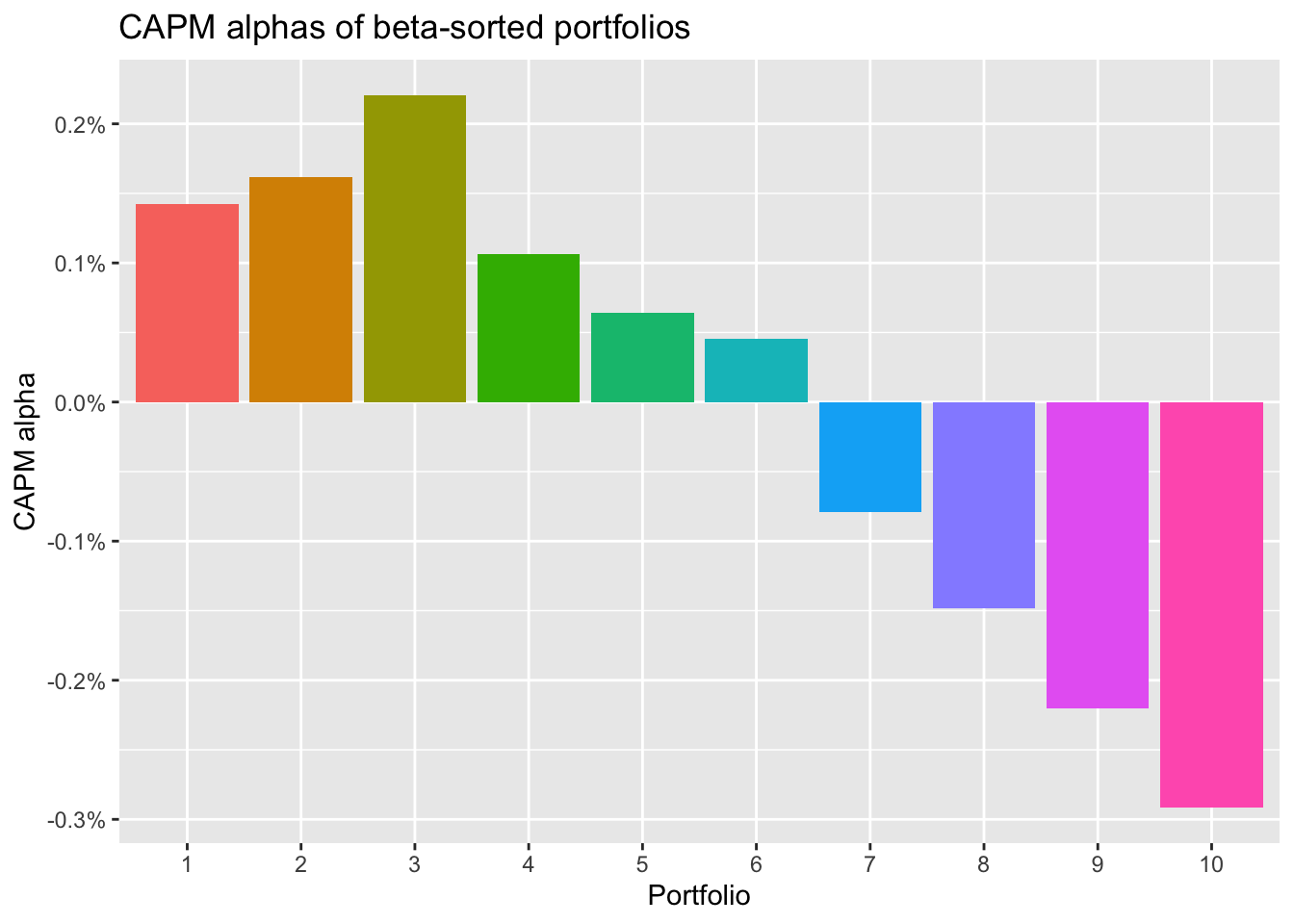

beta_portfolios_summary <-

beta_portfolios |>

left_join(factors_ff_monthly, by = "month") |>

group_by(portfolio) |>

collect() %>%

mutate(portfolio = as.factor(portfolio)) |>

summarize(

alpha = coef(lm(ret ~ 1 + mkt_excess))[1],

beta = coef(lm(ret ~ 1 + mkt_excess))[2],

ret = mean(ret)

)beta_portfolios_summary |>

ggplot(aes(x = portfolio, y = alpha, fill = portfolio)) +

geom_bar(stat = "identity") +

labs(

title = "CAPM alphas of beta-sorted portfolios",

x = "Portfolio",

y = "CAPM alpha",

fill = "Portfolio"

) +

scale_y_continuous(labels = percent) +

theme(legend.position = "None")

6.6 The Security Market Line and Beta Portfolios

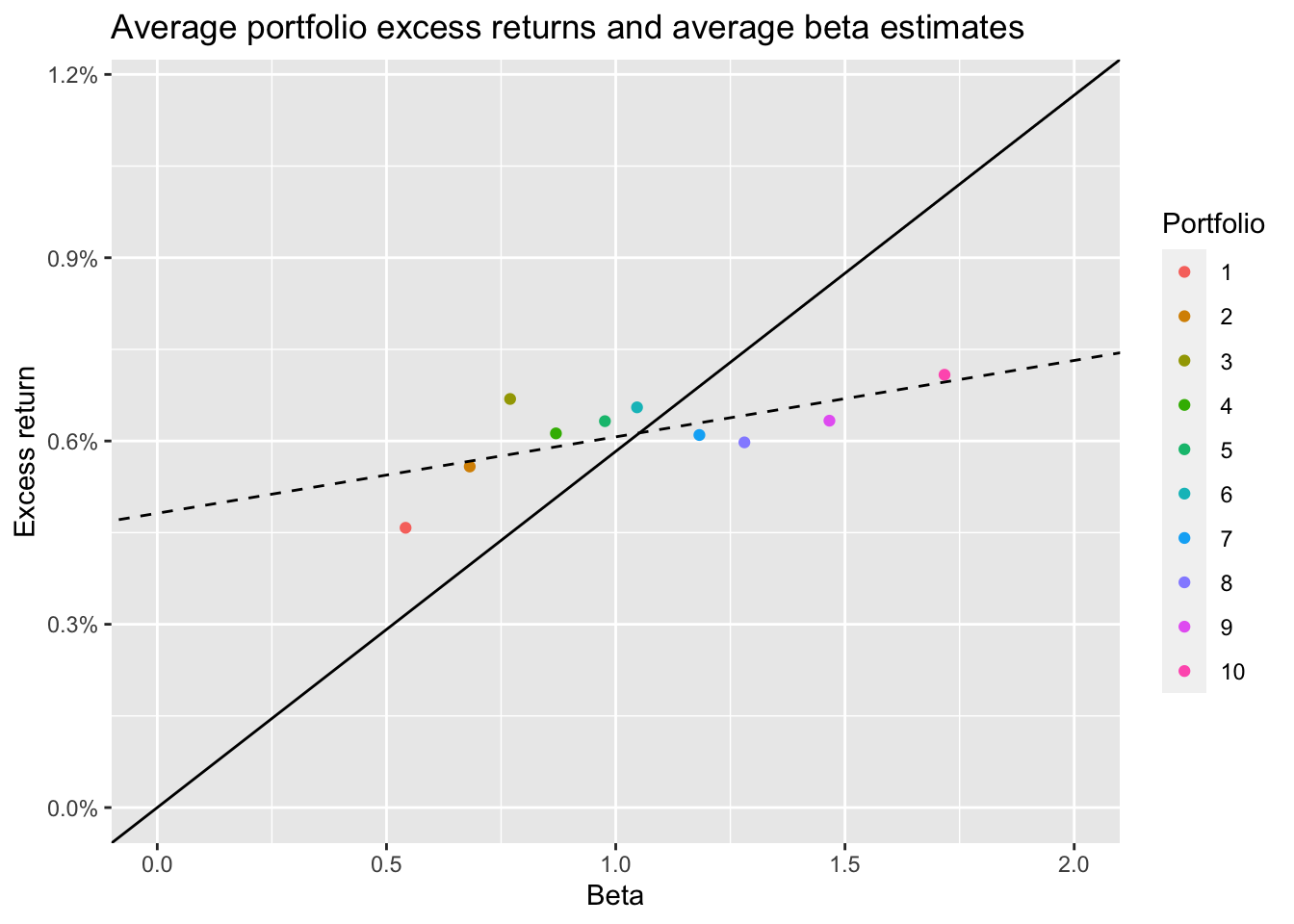

Again I use the coef() function and I also extract the calculation stored in mean_mkt_excess upfront.

sml_capm <- coef(lm(ret ~ 1 + beta, data = beta_portfolios_summary))

mean_mkt_excess <-

factors_ff_monthly |>

summarize(mean(mkt_excess, na.rm = TRUE)) |>

pull()

beta_portfolios_summary |>

filter(!is.na(ret), !is.na(beta)) |>

ggplot(aes(

x = beta,

y = ret,

color = portfolio

)) +

geom_point() +

geom_abline(

intercept = 0,

slope = mean_mkt_excess,

linetype = "solid"

) +

geom_abline(

intercept = sml_capm[1],

slope = sml_capm[2],

linetype = "dashed"

) +

scale_y_continuous(

labels = percent,

limit = c(0, mean_mkt_excess * 2)

) +

scale_x_continuous(limits = c(0, 2)) +

labs(

x = "Beta", y = "Excess return", color = "Portfolio",

title = "Average portfolio excess returns and average beta estimates"

)

The ungroup() shown in the book is not needed (because we used .groups = "drop") in the previous step.

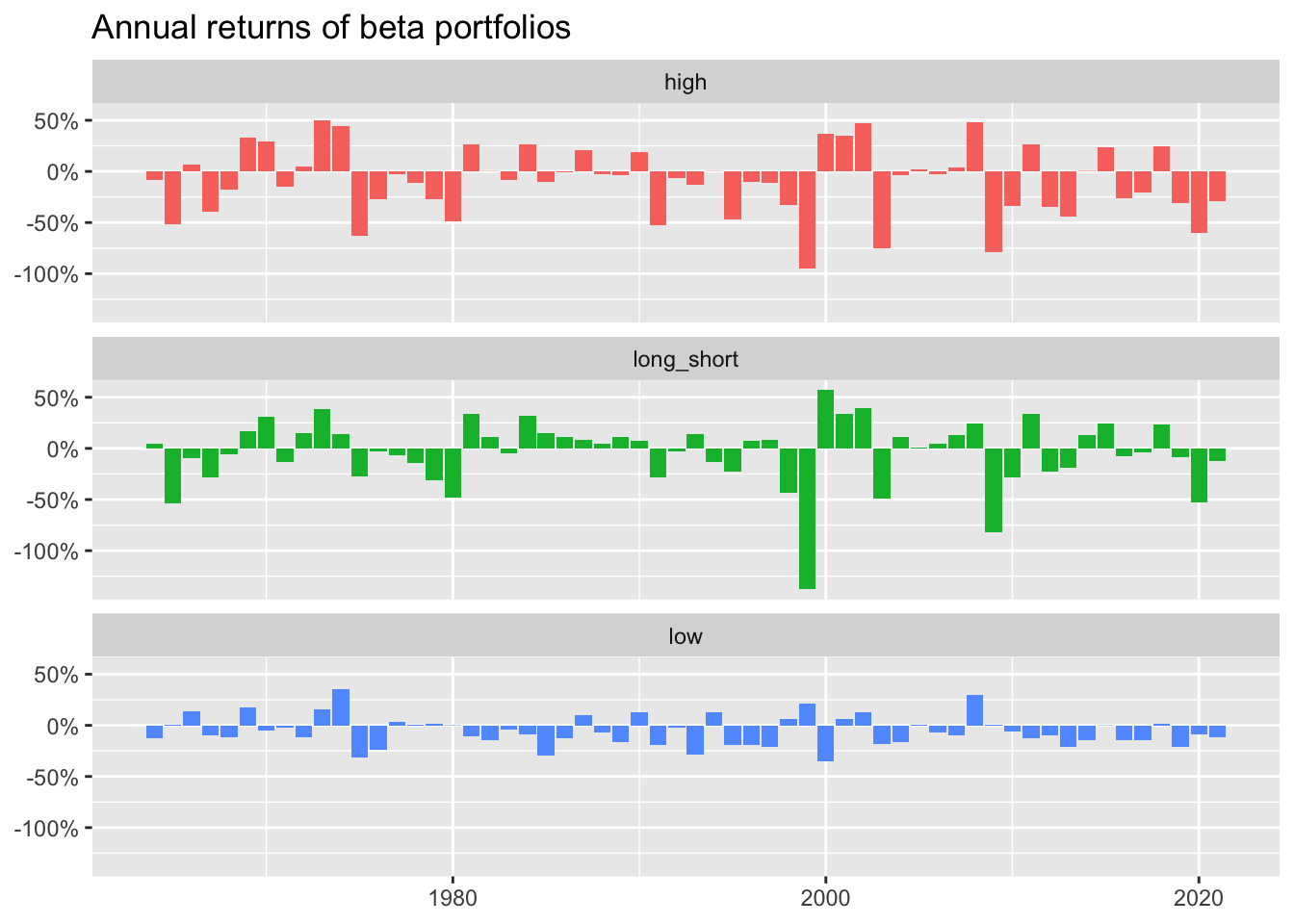

beta_longshort <-

beta_portfolios |>

mutate(portfolio = case_when(

portfolio == max(as.numeric(portfolio)) ~ "high",

portfolio == min(as.numeric(portfolio)) ~ "low"

)) |>

filter(portfolio %in% c("low", "high")) |>

pivot_wider(id_cols = month, names_from = portfolio, values_from = ret) |>

mutate(long_short = high - low) |>

left_join(factors_ff_monthly, by = "month") %>%

collect()Warning: Missing values are always removed in SQL aggregation functions.

Use `na.rm = TRUE` to silence this warning

This warning is displayed once every 8 hours.coeftest(lm(long_short ~ 1, data = beta_longshort),

vcov = NeweyWest)

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.0025049 0.0027858 0.8992 0.3689coeftest(lm(long_short ~ 1 + mkt_excess, data = beta_longshort),

vcov = NeweyWest)

t test of coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.0043407 0.0021566 -2.0128 0.04453 *

mkt_excess 1.1755556 0.0679566 17.2986 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1We have already applied collect() to beta_longshort, so we can use R functions here. If beta_longshort were a remote data frame, not that dbplyr does not translate prod() for us, but we could use the product() aggregate from DuckDB.

beta_longshort |>

group_by(year = year(month)) |>

summarize(

low = prod(1 + low),

high = prod(1 + high),

long_short = prod(1 + long_short)

) |>

pivot_longer(cols = -year) |>

ggplot(aes(x = year, y = 1 - value, fill = name)) +

geom_col(position = "dodge") +

facet_wrap(~name, ncol = 1) +

theme(legend.position = "none") +

scale_y_continuous(labels = percent) +

labs(

title = "Annual returns of beta portfolios",

x = NULL, y = NULL

)

dbDisconnect(tidy_finance, shutdown = TRUE)