library(tidyverse)

library(DBI)

library(scales)

library(sandwich)

library(lmtest)

library(dbplyr)

library(rlang)7 Size Sorts and p-Hacking

We do not need the furr package for the dbplyr version of the code, but we do load the dbplyr package so that we can access the window_order() function below.

library(tidyverse)

library(DBI)

library(scales)

library(sandwich)

library(lmtest)

library(furrr)

library(rlang)7.1 Data Preparation

tidy_finance <- dbConnect(

duckdb::duckdb(),

"data/tidy_finance.duckdb",

read_only = TRUE)

crsp_monthly <-

tbl(tidy_finance, "crsp_monthly")

factors_ff_monthly <-

tbl(tidy_finance, "factors_ff_monthly") tidy_finance <- dbConnect(

duckdb::duckdb(),

"data/tidy_finance.duckdb",

read_only = TRUE)

crsp_monthly <-

tbl(tidy_finance, "crsp_monthly") |>

collect()

factors_ff_monthly <-

tbl(tidy_finance, "factors_ff_monthly") |>

collect() 7.2 Size Distribution

In the following code, we need to make a few tweaks in translating it to dbplyr.

First, we want to extract the calculations of quantiles by month into a separate query. These calculations are grouped aggregates, so should happen inside a group_by()/summarize() query in SQL. We also include the calculation of total_market_cap in this query.

Second, I simplify the creation of the quantile indicators (e.g., top01). There is no need to write if_else(condition == TRUE, 1, 0) when condition will effectively yield the same result. This means that we do not need to write mktcap[top01 == 1], but can use mktcap[top01].

Third, the original approach has calculations such as sum(mktcap[top01 == 1]) / total_market_cap inside a summarize() call. However, SQL implementations are normally strict in requiring variables to appear either inside an aggregate function (e.g., sum()) or as part of the grouping (group_by or GROUP BY). In the original calculation is outside the sum() aggregate and not part of the grouping set (we have group_by(month)).

Fourth, because we want to use factors for the plot, we need to collect() before constructing the factor.

Otherwise the two approaches are the same.

monthly_quantiles <-

crsp_monthly |>

group_by(month) |>

summarize(

total_market_cap = sum(mktcap, na.rm = TRUE),

q_top01 = quantile(mktcap, 0.99),

q_top05 = quantile(mktcap, 0.95),

q_top10 = quantile(mktcap, 0.90),

q_top25 = quantile(mktcap, 0.75),

.groups = "drop")

crsp_monthly |>

inner_join(monthly_quantiles, by = "month") |>

mutate(

top01 = mktcap >= q_top01,

top05 = mktcap >= q_top05,

top10 = mktcap >= q_top10,

top25 = mktcap >= q_top25,

.groups = "drop") |>

group_by(month) |>

summarize(

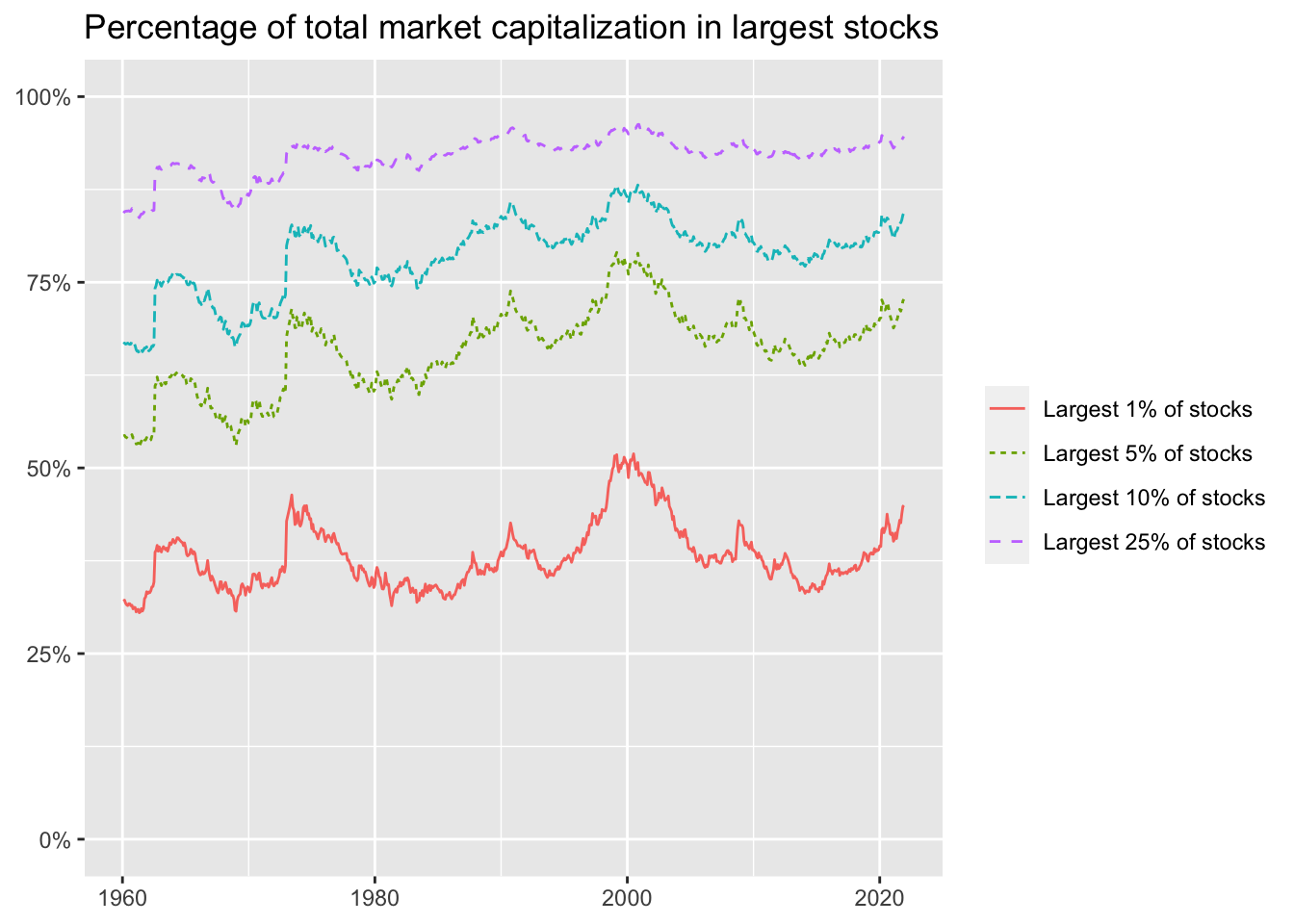

`Largest 1% of stocks` = sum(mktcap[top01]/total_market_cap),

`Largest 5% of stocks` = sum(mktcap[top05]/total_market_cap),

`Largest 10% of stocks` = sum(mktcap[top10]/total_market_cap),

`Largest 25% of stocks` = sum(mktcap[top25]/total_market_cap),

.groups = "drop") |>

pivot_longer(cols = -month) |>

collect() |>

mutate(name = factor(name, levels = c(

"Largest 1% of stocks", "Largest 5% of stocks",

"Largest 10% of stocks", "Largest 25% of stocks"

))) |>

ggplot(aes(

x = month,

y = value,

color = name,

linetype = name)) +

geom_line() +

scale_y_continuous(labels = percent, limits = c(0, 1)) +

labs(

x = NULL, y = NULL, color = NULL, linetype = NULL,

title = "Percentage of total market capitalization in largest stocks")

crsp_monthly |>

group_by(month) |>

mutate(

top01 = if_else(mktcap >= quantile(mktcap, 0.99), 1, 0),

top05 = if_else(mktcap >= quantile(mktcap, 0.95), 1, 0),

top10 = if_else(mktcap >= quantile(mktcap, 0.90), 1, 0),

top25 = if_else(mktcap >= quantile(mktcap, 0.75), 1, 0)

) |>

summarize(

total_market_cap = sum(mktcap),

`Largest 1% of stocks` = sum(mktcap[top01 == 1]) / total_market_cap,

`Largest 5% of stocks` = sum(mktcap[top05 == 1]) / total_market_cap,

`Largest 10% of stocks` = sum(mktcap[top10 == 1]) / total_market_cap,

`Largest 25% of stocks` = sum(mktcap[top25 == 1]) / total_market_cap,

.groups = "drop"

) |>

select(-total_market_cap) |>

pivot_longer(cols = -month) |>

mutate(name = factor(name, levels = c(

"Largest 1% of stocks", "Largest 5% of stocks",

"Largest 10% of stocks", "Largest 25% of stocks"

))) |>

ggplot(aes(

x = month,

y = value,

color = name,

linetype = name)) +

geom_line() +

scale_y_continuous(labels = percent, limits = c(0, 1)) +

labs(

x = NULL, y = NULL, color = NULL, linetype = NULL,

title = "Percentage of total market capitalization in largest stocks"

)The next code chunk is the same.

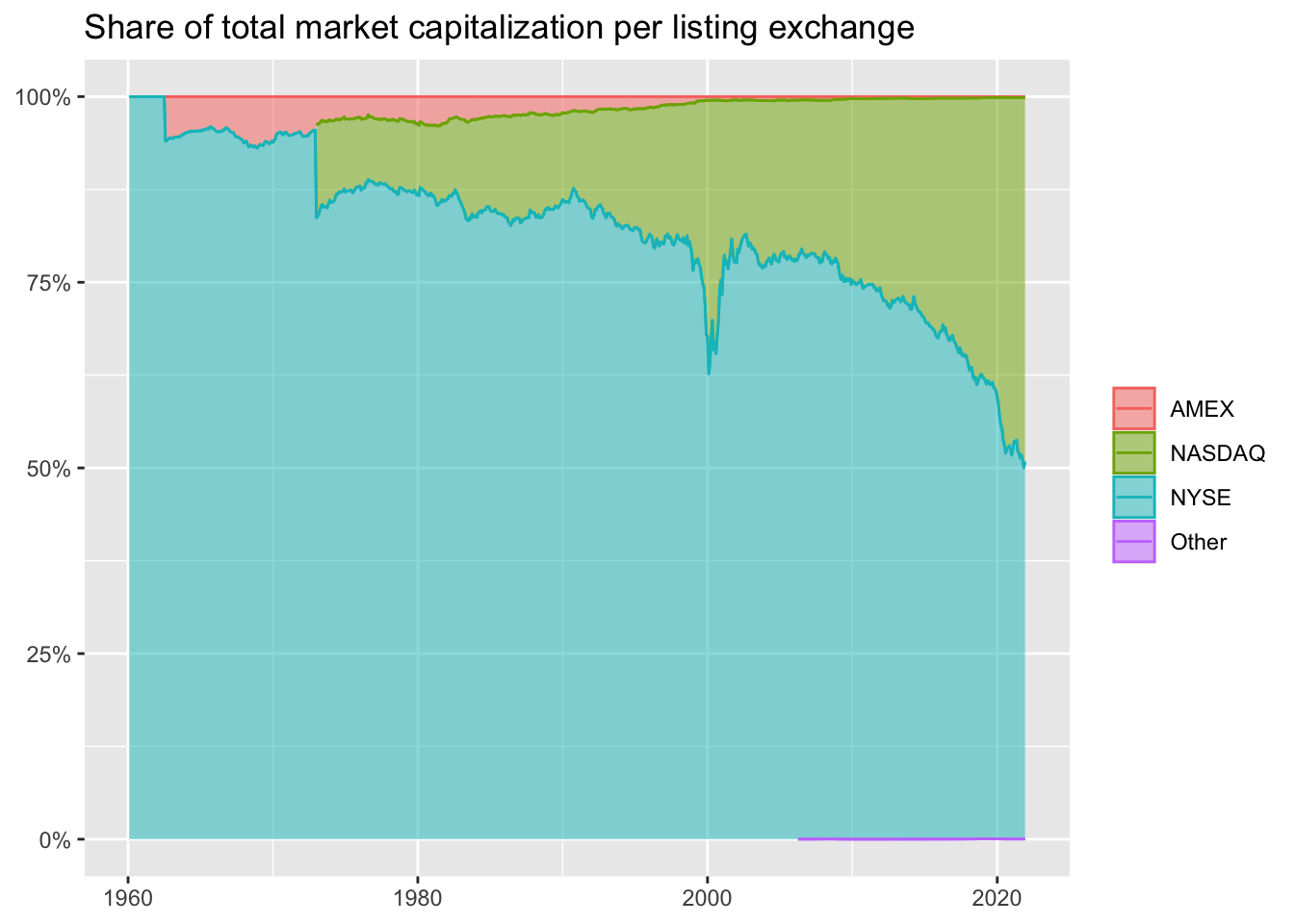

crsp_monthly |>

group_by(month, exchange) |>

summarize(mktcap = sum(mktcap),

.groups = "drop_last") |>

mutate(share = mktcap / sum(mktcap)) |>

ggplot(aes(

x = month,

y = share,

fill = exchange,

color = exchange)) +

geom_area(

position = "stack",

stat = "identity",

alpha = 0.5

) +

geom_line(position = "stack") +

scale_y_continuous(labels = percent) +

labs(

x = NULL, y = NULL, fill = NULL, color = NULL,

title = "Share of total market capitalization per listing exchange"

)

create_summary <- function(data, column_name) {

data |>

select(value = {{ column_name }}) |>

summarize(

mean = mean(value),

sd = sd(value),

min = min(value),

q05 = quantile(value, 0.05),

q50 = quantile(value, 0.50),

q95 = quantile(value, 0.95),

max = max(value),

n = n()

)

}

crsp_monthly |>

filter(month == max(month)) |>

group_by(exchange) |>

create_summary(mktcap) |>

arrange(exchange) |>

union_all(crsp_monthly |>

filter(month == max(month)) |>

create_summary(mktcap) |>

mutate(exchange = "Overall")) |>

collect()Adding missing grouping variables: `exchange`| exchange | mean | sd | min | q05 | q50 | q95 | max | n |

|---|---|---|---|---|---|---|---|---|

| AMEX | 414.7685 | 2180.64 | 7.56557 | 12.55276 | 75.83695 | 1218.314 | 25718.89 | 145 |

| NASDAQ | 8650.8801 | 90037.57 | 7.00553 | 29.30835 | 429.09850 | 18780.584 | 2902368.14 | 2779 |

| NYSE | 17857.7021 | 48618.73 | 23.91300 | 194.98000 | 3433.58503 | 80748.492 | 472941.07 | 1395 |

| Other | 13906.2461 | NA | 13906.24613 | 13906.24613 | 13906.24613 | 13906.246 | 13906.25 | 1 |

| Overall | 11348.6893 | 77458.26 | 7.00553 | 34.31473 | 795.59922 | 40647.106 | 2902368.14 | 4320 |

create_summary <- function(data, column_name) {

data |>

select(value = {{ column_name }}) |>

summarize(

mean = mean(value),

sd = sd(value),

min = min(value),

q05 = quantile(value, 0.05),

q50 = quantile(value, 0.50),

q95 = quantile(value, 0.95),

max = max(value),

n = n()

)

}

crsp_monthly |>

filter(month == max(month)) |>

group_by(exchange) |>

create_summary(mktcap) |>

add_row(crsp_monthly |>

filter(month == max(month)) |>

create_summary(mktcap) |>

mutate(exchange = "Overall"))get_breaks <- function(data, n_portfolios, exchanges) {

ports <- 0:n_portfolios

ports_sql <- sql(paste0("[", paste(ports, collapse = ", "), "]"))

breaks <- seq(0, 1, 1/n_portfolios)

breaks_sql <- sql(paste0("[", paste(breaks, collapse = ", "), "]"))

data |>

filter(exchange %in% exchanges) |>

summarize(portfolio = ports_sql,

breaks = quantile_cont(mktcap_lag, breaks_sql),

.groups = "keep") %>%

mutate(portfolio = unnest(portfolio),

breaks = unnest(breaks)) |>

group_by(month) |>

window_order(portfolio) |>

mutate(port_max = if_else(portfolio == n_portfolios, Inf, breaks),

port_min = if_else(portfolio == 1, -Inf, lag(breaks))) |>

filter(portfolio > 0) |>

select(month, portfolio, port_max, port_min) |>

ungroup() |>

compute()

}

assign_portfolio <- function(data, n_portfolios, exchanges) {

breaks <- get_breaks(data, n_portfolios, exchanges)

data |>

inner_join(breaks,

join_by(month,

mktcap_lag >= port_min,

mktcap_lag < port_max)) |>

select(-port_min, -port_max)

}assign_portfolio <- function(n_portfolios,

exchanges,

data) {

breakpoints <- data |>

filter(exchange %in% exchanges) |>

reframe(breakpoint = quantile(

mktcap_lag,

probs = seq(0, 1, length.out = n_portfolios + 1),

na.rm = TRUE

)) |>

pull(breakpoint) |>

as.numeric()

assigned_portfolios <- data |>

mutate(portfolio = findInterval(mktcap_lag,

breakpoints,

all.inside = TRUE

)) |>

pull(portfolio)

return(assigned_portfolios)

}Here I tweak the code so that the data argument comes first in compute_portfolio_returns(). This facilitates a pipe-based approach, which I use below in the dbplyr code.

With the dbplyr approach we have no weighted.mean() function to use. Instead, we calculate the weighted mean “by hand” and set weight = if_else(value_weighted, mktcap_lag, 1) (i.e., weight is mktcap_lag for value-weighted returns, but one otherwise).

compute_portfolio_returns <-

function(data = crsp_monthly,

n_portfolios = 10,

exchanges = c("NYSE", "NASDAQ", "AMEX"),

value_weighted = TRUE) {

exchanges_str <- str_flatten(exchanges, ", ")

data |>

group_by(month) |>

assign_portfolio(n_portfolios, exchanges) |>

group_by(month, portfolio) |>

filter(!is.na(ret), !is.na(mktcap_lag)) |>

mutate(weight = if_else(value_weighted, mktcap_lag, 1)) |>

summarize(

ret = sum(ret_excess * weight, na.rm = TRUE)/

sum(weight, na.rm = TRUE),

.groups = "drop") |>

mutate(portfolio = case_when(portfolio == min(portfolio) ~ "min",

portfolio == max(portfolio) ~ "max",

TRUE ~ "other")) |>

filter(portfolio %in% c("min", "max")) |>

pivot_wider(names_from = portfolio, values_from = ret) |>

mutate(size_premium = min - max) |>

summarize(size_premium = mean(size_premium)) |>

mutate(exchanges = exchanges_str) |>

select(exchanges, size_premium) |>

collect()

}compute_portfolio_returns <-

function(data = crsp_monthly,

n_portfolios = 10,

exchanges = c("NYSE", "NASDAQ", "AMEX"),

value_weighted = TRUE) {

data |>

group_by(month) |>

mutate(portfolio = assign_portfolio(

n_portfolios = n_portfolios,

exchanges = exchanges,

data = pick(everything())

)) |>

group_by(month, portfolio) |>

summarize(

ret = if_else(value_weighted,

weighted.mean(ret_excess, mktcap_lag),

mean(ret_excess)

),

.groups = "drop_last"

) |>

summarize(size_premium = ret[portfolio == min(portfolio)] -

ret[portfolio == max(portfolio)]) |>

summarize(size_premium = mean(size_premium))

}ret_all <-

crsp_monthly |>

compute_portfolio_returns(n_portfolios = 2,

exchanges = c("NYSE", "NASDAQ", "AMEX"),

value_weighted = TRUE)

ret_nyse <-

crsp_monthly |>

compute_portfolio_returns(n_portfolios = 2,

exchanges = "NYSE",

value_weighted = TRUE)

bind_rows(ret_all, ret_nyse)| exchanges | size_premium |

|---|---|

| NYSE, NASDAQ, AMEX | 0.000975 |

| NYSE | 0.001664 |

ret_all <- compute_portfolio_returns(

n_portfolios = 2,

exchanges = c("NYSE", "NASDAQ", "AMEX"),

value_weighted = TRUE,

data = crsp_monthly

)

ret_nyse <- compute_portfolio_returns(

n_portfolios = 2,

exchanges = "NYSE",

value_weighted = TRUE,

data = crsp_monthly

)

tibble(

Exchanges = c("NYSE, NASDAQ & AMEX", "NYSE"),

Premium = as.numeric(c(ret_all, ret_nyse)) * 100

)The code for p_hacking_setup is common across the two approaches.

p_hacking_setup <-

expand_grid(

n_portfolios = c(2, 5, 10),

exchanges = list("NYSE", c("NYSE", "NASDAQ", "AMEX")),

value_weighted = c(TRUE, FALSE),

data = parse_exprs(

'crsp_monthly;

crsp_monthly |> filter(industry != "Finance");

crsp_monthly |> filter(month < "1990-06-01");

crsp_monthly |> filter(month >="1990-06-01")'))Because DuckDB will use multiple cores without explicit instructions, I don’t need to set up multisession with the dbplyr approach.

p_hacking_setup <-

p_hacking_setup |>

mutate(size_premium =

pmap(.l = list(data, n_portfolios, exchanges, value_weighted),

.f = ~ compute_portfolio_returns(

data = eval_tidy(..1),

n_portfolios = ..2,

exchanges = ..3,

value_weighted = ..4)))plan(multisession, workers = availableCores())

p_hacking_setup <- p_hacking_setup |>

mutate(size_premium = future_pmap(

.l = list(

n_portfolios,

exchanges,

value_weighted,

data

),

.f = ~ compute_portfolio_returns(

n_portfolios = ..1,

exchanges = ..2,

value_weighted = ..3,

data = eval_tidy(..4)

)

))p_hacking_results <-

p_hacking_setup |>

select(-exchanges) |>

mutate(data = map_chr(data, deparse)) |>

unnest(size_premium) |>

arrange(desc(size_premium)) |>

filter(!is.na(size_premium))

p_hacking_results| n_portfolios | value_weighted | data | exchanges | size_premium |

|---|---|---|---|---|

| 10 | FALSE | filter(crsp_monthly, month >= “1990-06-01”) | NYSE, NASDAQ, AMEX | 0.0186423 |

| 10 | FALSE | filter(crsp_monthly, industry != “Finance”) | NYSE, NASDAQ, AMEX | 0.0182132 |

| 10 | FALSE | crsp_monthly | NYSE, NASDAQ, AMEX | 0.0163249 |

| 10 | FALSE | filter(crsp_monthly, month < “1990-06-01”) | NYSE, NASDAQ, AMEX | 0.0139120 |

| 10 | TRUE | filter(crsp_monthly, industry != “Finance”) | NYSE, NASDAQ, AMEX | 0.0115089 |

| 10 | TRUE | filter(crsp_monthly, month < “1990-06-01”) | NYSE, NASDAQ, AMEX | 0.0109079 |

| 10 | TRUE | crsp_monthly | NYSE, NASDAQ, AMEX | 0.0102892 |

| 10 | TRUE | filter(crsp_monthly, month >= “1990-06-01”) | NYSE, NASDAQ, AMEX | 0.0096950 |

| 5 | FALSE | filter(crsp_monthly, industry != “Finance”) | NYSE, NASDAQ, AMEX | 0.0092400 |

| 5 | FALSE | filter(crsp_monthly, month >= “1990-06-01”) | NYSE, NASDAQ, AMEX | 0.0089425 |

| 5 | FALSE | crsp_monthly | NYSE, NASDAQ, AMEX | 0.0081521 |

| 5 | FALSE | filter(crsp_monthly, month < “1990-06-01”) | NYSE, NASDAQ, AMEX | 0.0073290 |

| 10 | FALSE | filter(crsp_monthly, industry != “Finance”) | NYSE | 0.0053042 |

| 10 | FALSE | filter(crsp_monthly, month >= “1990-06-01”) | NYSE | 0.0049717 |

| 10 | FALSE | crsp_monthly | NYSE | 0.0048490 |

| 5 | TRUE | filter(crsp_monthly, month < “1990-06-01”) | NYSE, NASDAQ, AMEX | 0.0048375 |

| 10 | FALSE | filter(crsp_monthly, month < “1990-06-01”) | NYSE | 0.0047213 |

| 5 | TRUE | filter(crsp_monthly, industry != “Finance”) | NYSE, NASDAQ, AMEX | 0.0040888 |

| 5 | FALSE | filter(crsp_monthly, industry != “Finance”) | NYSE | 0.0039463 |

| 5 | FALSE | filter(crsp_monthly, month < “1990-06-01”) | NYSE | 0.0037026 |

| 5 | TRUE | crsp_monthly | NYSE, NASDAQ, AMEX | 0.0036889 |

| 5 | FALSE | crsp_monthly | NYSE | 0.0036439 |

| 5 | FALSE | filter(crsp_monthly, month >= “1990-06-01”) | NYSE | 0.0035875 |

| 2 | FALSE | filter(crsp_monthly, month >= “1990-06-01”) | NYSE, NASDAQ, AMEX | 0.0032007 |

| 2 | FALSE | filter(crsp_monthly, industry != “Finance”) | NYSE, NASDAQ, AMEX | 0.0031721 |

| 2 | FALSE | crsp_monthly | NYSE, NASDAQ, AMEX | 0.0027854 |

| 2 | FALSE | filter(crsp_monthly, industry != “Finance”) | NYSE | 0.0026137 |

| 5 | TRUE | filter(crsp_monthly, month >= “1990-06-01”) | NYSE, NASDAQ, AMEX | 0.0025858 |

| 10 | TRUE | filter(crsp_monthly, month < “1990-06-01”) | NYSE | 0.0025788 |

| 2 | FALSE | filter(crsp_monthly, month >= “1990-06-01”) | NYSE | 0.0025544 |

| 2 | FALSE | filter(crsp_monthly, month < “1990-06-01”) | NYSE, NASDAQ, AMEX | 0.0023529 |

| 2 | FALSE | crsp_monthly | NYSE | 0.0023461 |

| 5 | TRUE | filter(crsp_monthly, month < “1990-06-01”) | NYSE | 0.0021397 |

| 2 | FALSE | filter(crsp_monthly, month < “1990-06-01”) | NYSE | 0.0021292 |

| 2 | TRUE | filter(crsp_monthly, month < “1990-06-01”) | NYSE | 0.0021229 |

| 10 | TRUE | crsp_monthly | NYSE | 0.0018741 |

| 10 | TRUE | filter(crsp_monthly, industry != “Finance”) | NYSE | 0.0018642 |

| 2 | TRUE | filter(crsp_monthly, industry != “Finance”) | NYSE | 0.0016826 |

| 2 | TRUE | crsp_monthly | NYSE | 0.0016640 |

| 5 | TRUE | crsp_monthly | NYSE | 0.0016331 |

| 5 | TRUE | filter(crsp_monthly, industry != “Finance”) | NYSE | 0.0015835 |

| 2 | TRUE | filter(crsp_monthly, month >= “1990-06-01”) | NYSE | 0.0012233 |

| 10 | TRUE | filter(crsp_monthly, month >= “1990-06-01”) | NYSE | 0.0011973 |

| 5 | TRUE | filter(crsp_monthly, month >= “1990-06-01”) | NYSE | 0.0011465 |

| 2 | TRUE | filter(crsp_monthly, month < “1990-06-01”) | NYSE, NASDAQ, AMEX | 0.0011415 |

| 2 | TRUE | crsp_monthly | NYSE, NASDAQ, AMEX | 0.0009750 |

| 2 | TRUE | filter(crsp_monthly, industry != “Finance”) | NYSE, NASDAQ, AMEX | 0.0008569 |

| 2 | TRUE | filter(crsp_monthly, month >= “1990-06-01”) | NYSE, NASDAQ, AMEX | 0.0008150 |

p_hacking_results <- p_hacking_setup |>

mutate(data = map_chr(data, deparse)) |>

unnest(size_premium) |>

arrange(desc(size_premium))

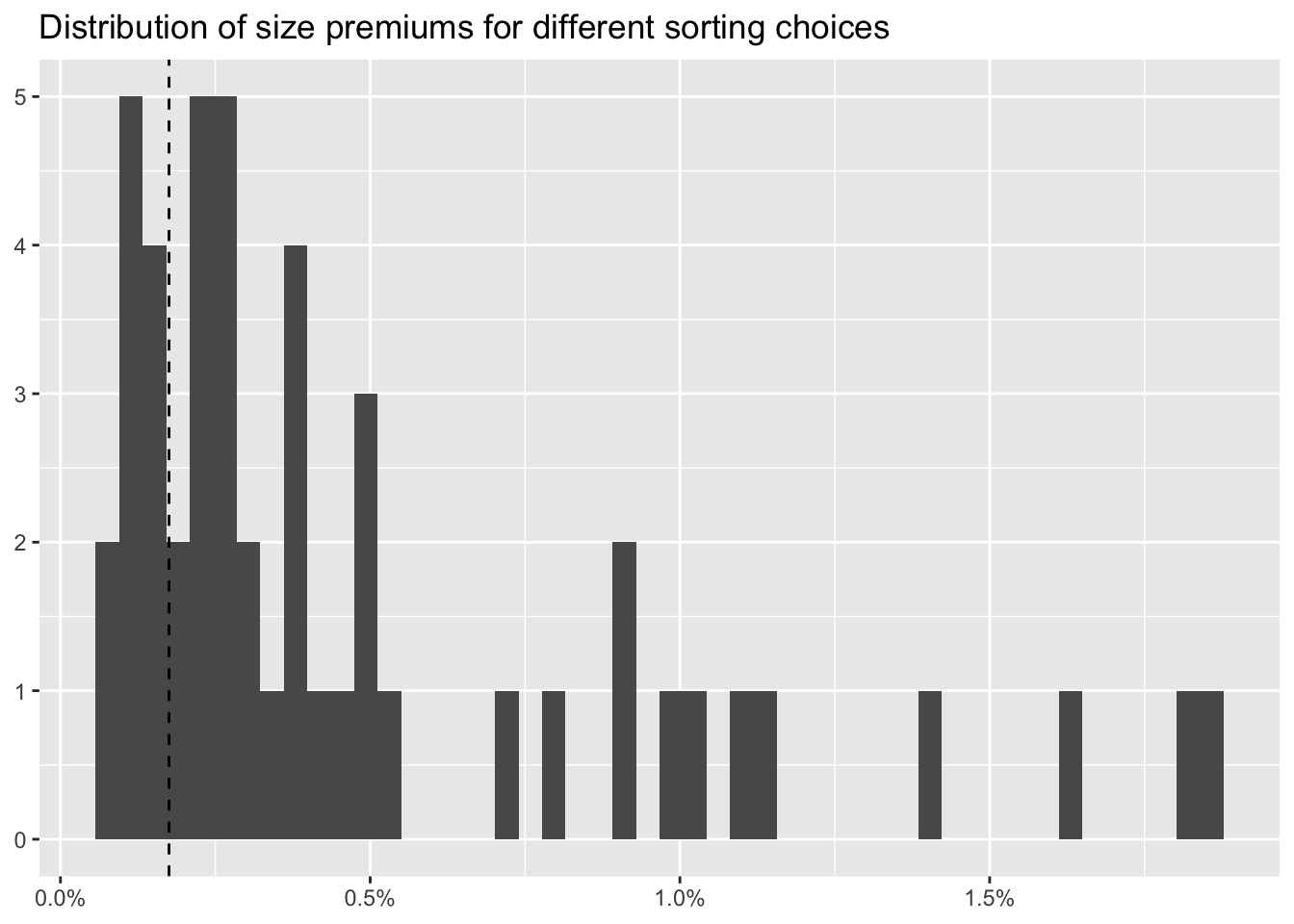

p_hacking_resultssmb_mean <-

factors_ff_monthly |>

summarize(mean(smb, na.rm = TRUE)) |>

pull()

p_hacking_results |>

ggplot(aes(x = size_premium)) +

geom_histogram(bins = nrow(p_hacking_results)) +

labs(

x = NULL, y = NULL,

title = "Distribution of size premiums for different sorting choices"

) +

geom_vline(aes(xintercept = smb_mean),

linetype = "dashed"

) +

scale_x_continuous(labels = percent)

Finally, we close the database.

dbDisconnect(tidy_finance, shutdown = TRUE)